are hearing aids tax deductible as a business expense

In general a taxpayer may deduct qualified medical expenses not covered by insurance to the extent the expenses exceed 75 of the taxpayers adjusted gross income. The stipulation here for most people is that your medical.

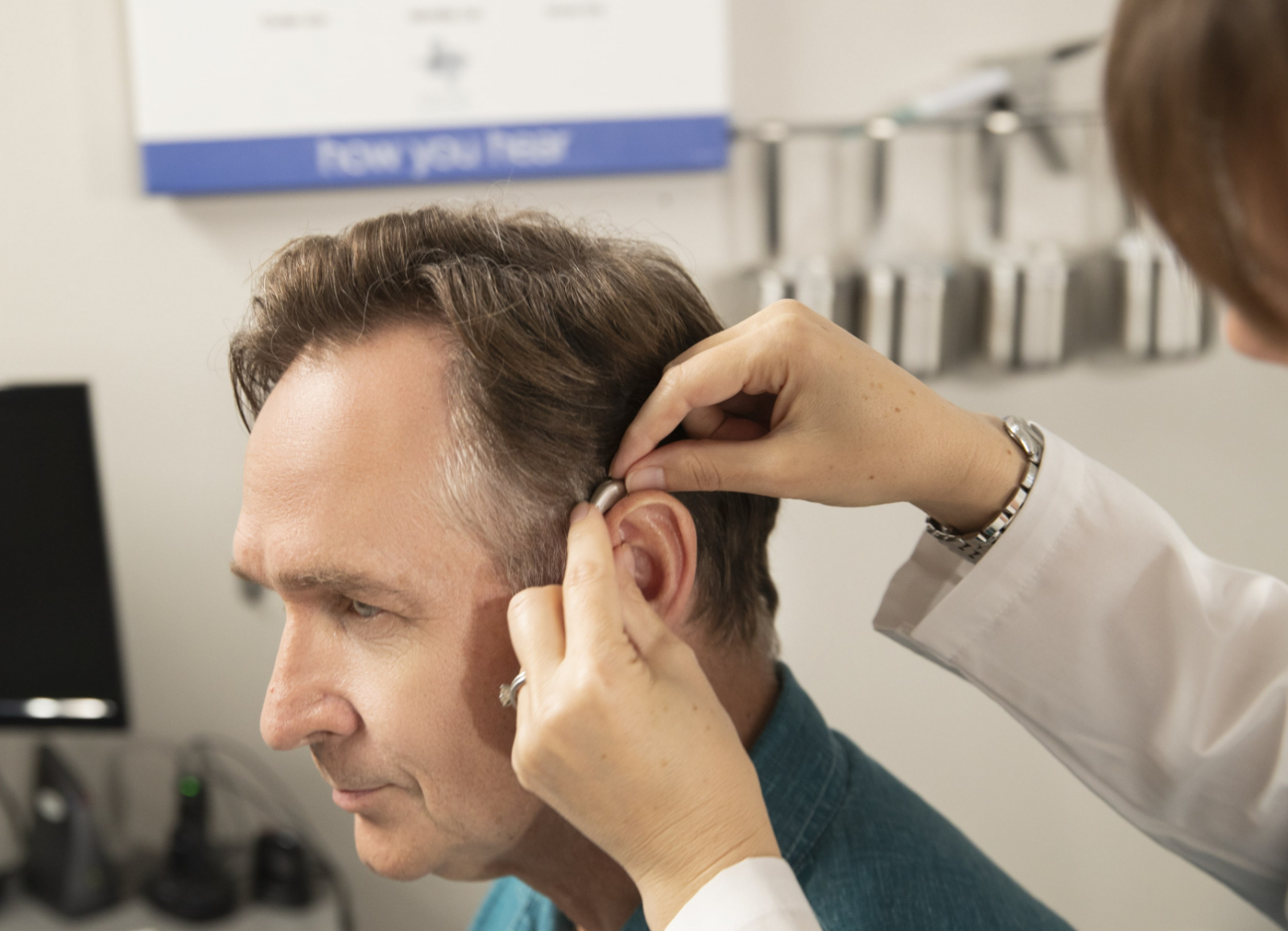

Hearing Aids And Tax Time Is A Hearing Aid Tax Deductible

Track Your Hearing Loss Expenses.

. VAT Value Added Tax is a tax that you pay when you buy goods and. Hearing aids can often qualify as a tax deduction though there are still several stipulations that the 10 million Americans with hearing aids will want to pay attention to. Schedule C deductible or no.

Since hearing loss is considered a medical condition and hearing aids. The deductions for these costs are only available to those who itemize their expenses. If the company pays for the.

The good news is that if you have an income and pay income tax you can claim a tax offset for any out-of-pocket costs on your hearing aids. Many of your medical expenses are considered eligible deductions by the federal government. If a directors hearing deteriorates to the point where hearing aids are required to enable adequate communication both at work and privately.

The short and sweet answer is yes. Hearing aids can often qualify as a tax deduction though there are still several stipulations that the 10 million americans with hearing aids will want to pay attention to. In order for hearing.

Income tax rebate for hearing aids. If you take a business deduction for these impairment-related work expenses they are not subject to the 75 limit that applies to medical expenses. Medical expenses including hearing aids can be claimed if you itemize your deductions.

If your business is VAT registered you can also claim back the VAT you paid on certain hearing devices and accessories. Hearing aids are most certainly a medical expense that is tax-deductible in Canada. As a general rule you can deduct your medical expenses as an itemized deduction to the extent that you spend more than 75 of your Adjusted Gross Income during.

However there are saidsome things to consider and. You are disabled if you. The cost of hearing aids can be as high as 75 of your adjusted gross income so.

Hearing aids like most medical expenses are sometimes tax-deductible reducing the overall outlay. By deducting the cost of hearing aids from their taxable income wearers could reduce. How To Pair Compilot With Hearing Aids Are Medical Expenses Tax Your medical expenses may be tax-deductible under certain circumstances.

Well the good news is that if you are a sole trader you may be able to claim tax relief on hearing aids or any other disability aids against your business profits.

Disability Tax Deduction For Wheelchair Vans Braunability

Tax Deductions For Convention And Educational Seminar Attendance The Hearing Review

Tax Prep Checklist The Documents Needed To File Your Taxes

Hearing Aid Insurance Verification Faq And Answers

Are Medical Expenses Tax Deductible Chime

Are Hearing Aids Tax Deductible Sound Relief Hearing Center

Medical Expenses And Your Taxes

Are Medical Expenses Tax Deductible Community Tax

Are Medical Expenses Tax Deductible Turbotax Tax Tips Videos

Ada Tax Credit And Tax Deduction For Ada Website Compliance

Medical Expenses What It Takes To Qualify For A Tax Deduction Doeren Mayhew Cpas

Overlooked Tax Deductions And Tips For Seniors Taxact Blog

How To Deduct Home Care Expenses On My Taxes

![]()

Are Hearing Aids Tax Deductible What You Should Know

Great News For Tax Season Your Hearing Aids Are Deductible Hearing Associates Of Northern Virginia

Are Hearing Aids Tax Deductible Sound Relief Hearing Center

Are Hearing Aids A Deductible Income Tax Expense

Can You Qualify For A Medical Expense Tax Deduction Mauldin Jenkins