how are rsus taxed at ipo

An IPO triggers taxes for RSUs even if you arent ready to sell the shares. I vested 2 years worth of RSUs.

Should I Withhold 22 Or 37 On My Rsus When My Company Goes Public Flow Financial Planning Llc

Once the liquidity event has occurred the shares vest 180 days later.

. Carol Nachbaur April 29 2022. My grant price per RSU was 20. With RSUs you are taxed when the shares are delivered which is.

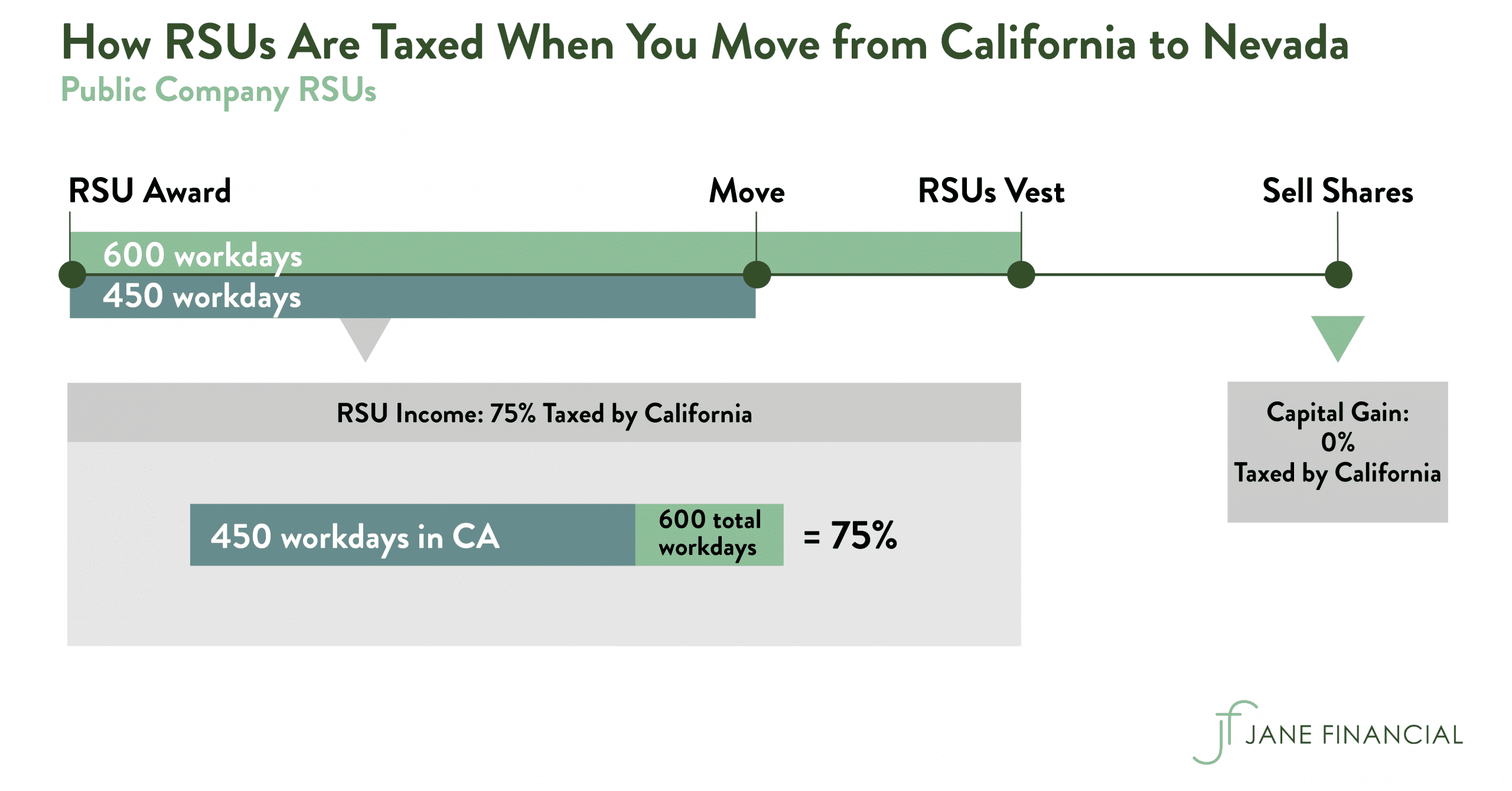

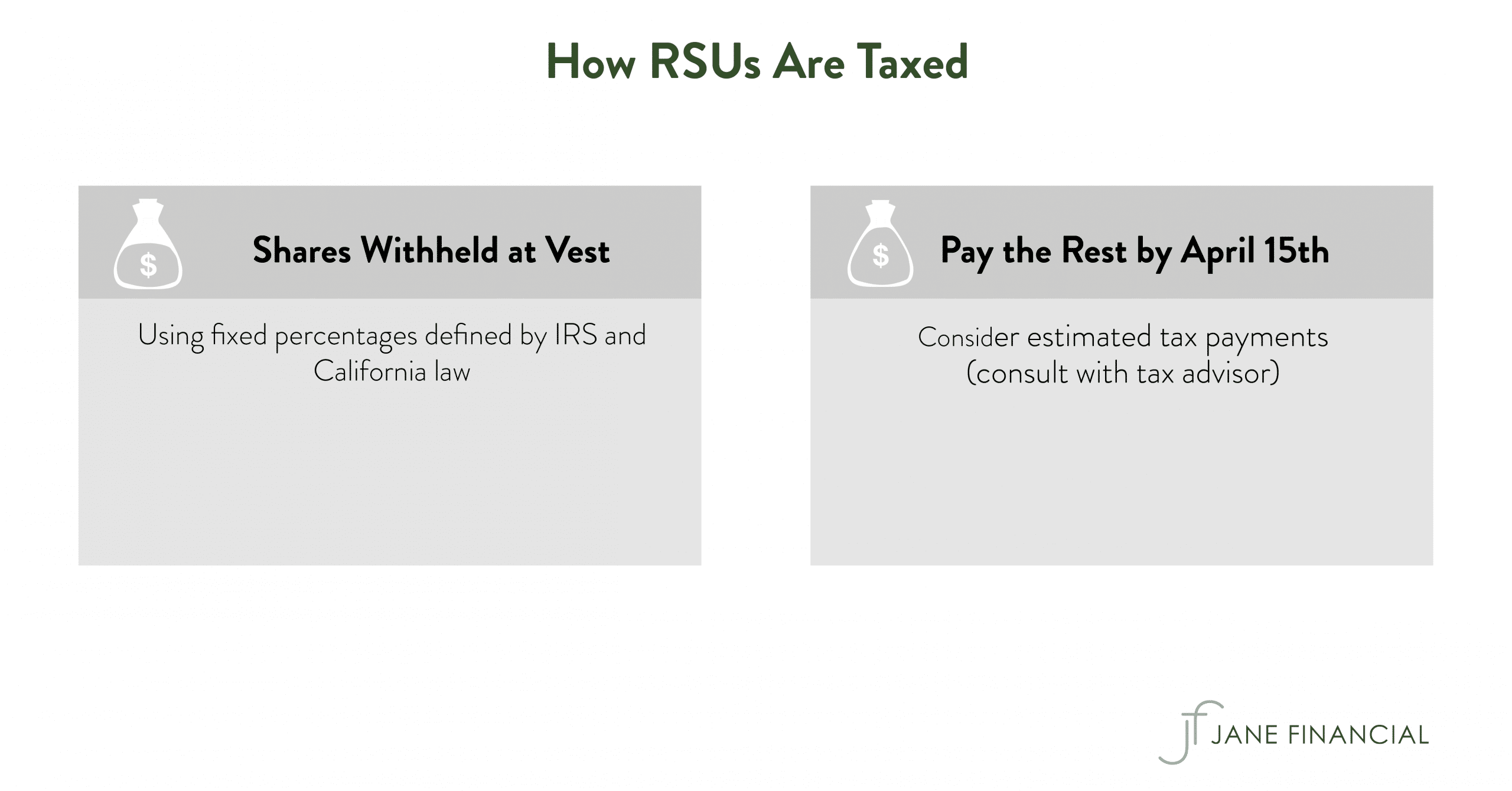

Restricted Stock Units RSUs Jan 1. Supplemental wages are taxed based on a series of flat rates as defined the IRS and your state tax authority. RSUs can trigger capital gains tax.

So combined with the quote you gave unless the terms of the RSU specify otherwise. Answer 1 of 3. For estimating taxes for IPOs.

Typically some number of shares get withheld. RSUs get taxed as regular income on the day you receive the stock the vesting date taxed based on the stock price that day. RSU Taxes - A tech employees guide to tax on restricted stock units.

That is the required withholdings can be met with a cash payment from the employee or the company can. Since Facebooks IPO other private tech giantsboth unicorns and non-unicornshave followed suit. The termination of an employee always halts the vesting process unless.

Many employees receive restricted stock units RSUs as a part of. Hi Blind making some numbers up to stay anonymousI was given 100k worth RSUs vestable quarterly over 4 years. Outside investors whove been wanting to purchase company equity can finally.

If I receive RSUs from a pre-IPO company on a 4 year vesting schedule when do my RSUs get taxed. And yes you are able to report capital losses on your taxes but its not. An IPO triggers taxes for RSUs even if you arent ready to sell the shares.

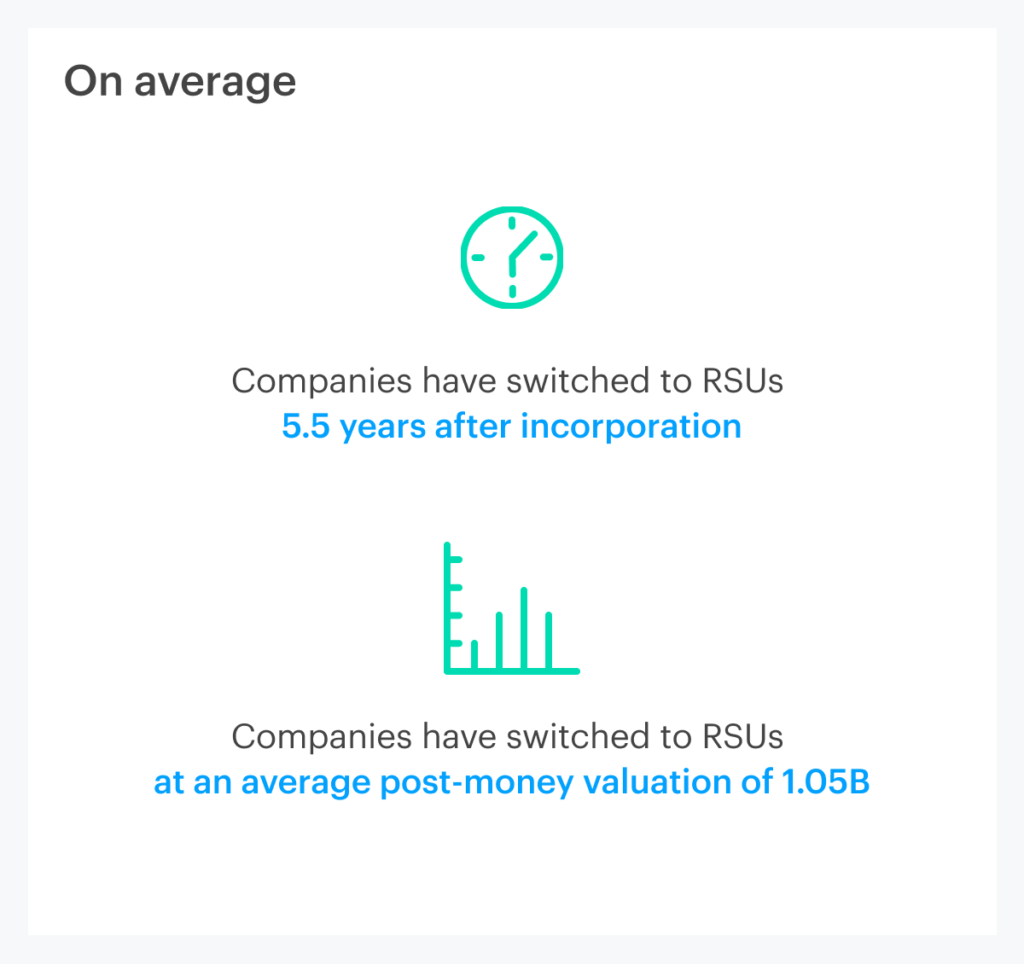

How Private Company RSUs Should Work During an IPO in my opinion In my previous blog post about RSUs in private companies. Double-trigger vesting was a major innovation to RSUs. As the private company matures and moves toward an IPO or acquisition equity grants tend to shift toward restricted.

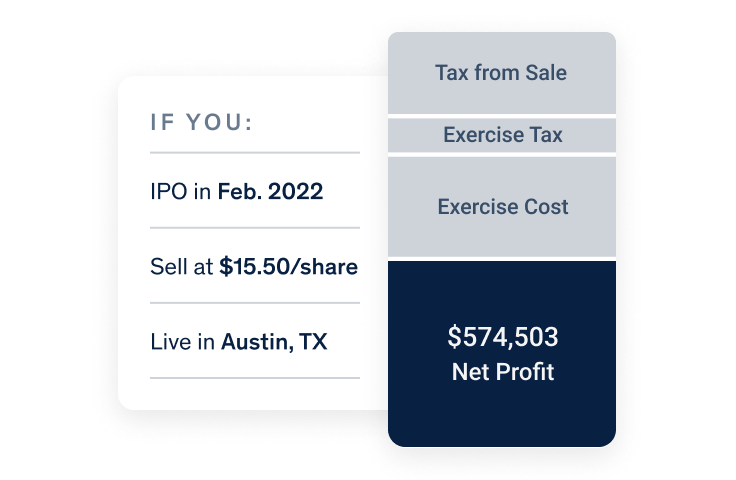

This online calculator allows you to estimate both federal and state taxes due to an IPO or vested. For private companies it works the same way as public companies. So please make sure you understand.

Without a liquid market to sell shares it can be challenging for employees at pre-IPO companies to pay the taxes as their RSUs vest either because they dont want to pay. New IPO companies may also utilize grants during a liquidity event before the IPO and shares vest. IPOs are causing a lot of excitement.

Expect RSUs In A Later-Stage Private Company. Answer 1 of 3. Your company has its IPO.

Should We Sell Or Keep Rsus Quora

How Are Incentive Stock Options Isos Taxed

Uber Ipo Why Some Early Employees Are Stunned By Taxes Protocol

14 Ipo Tax Strategy Ideas Stock Options Tax Strategies

Rsus Vs Options What S The Difference How To Switch Carta

What Is Restricted Stock Does It Differ From Restricted Securities Mystockoptions Com

What You Need To Know About Restricted Stock Units Rsus

Restricted Stock Units Jane Financial

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Restricted Stock Units Jane Financial

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

What Is A Restricted Stock Unit Rsu Everything You Should Know Carta

Faang Restricted Stock Units Vs Startup Equity Kofi Group

Rsa Vs Rsu All You Need To Know Eqvista

Tax Accounting And Startups Rsus Restricted Stock Units

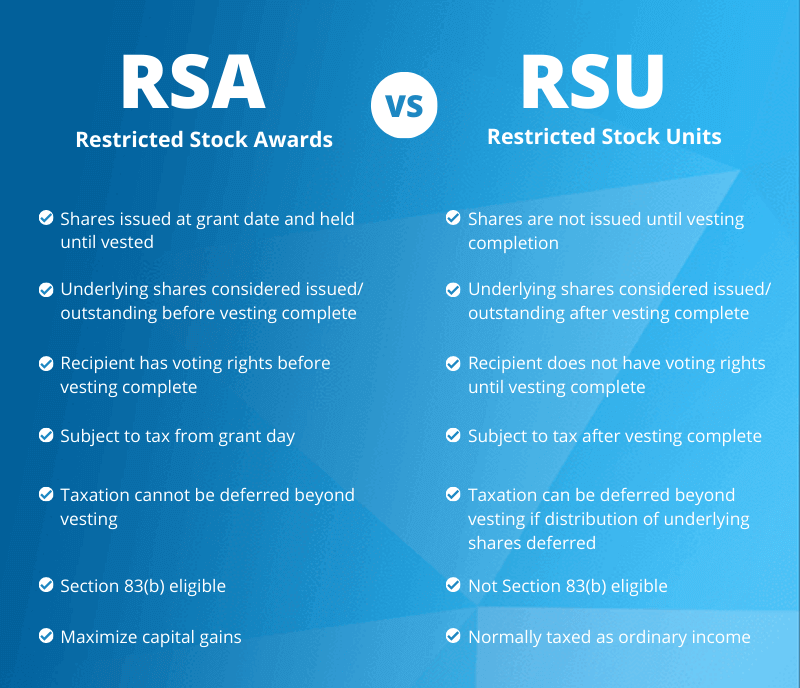

Equity Compensation Restricted Stock Units Vs Restricted Stock Awards Ipohub

.png)